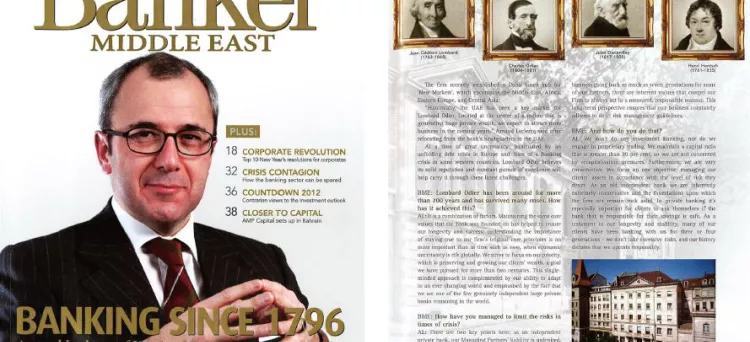

Banking since 1796

Lombard Odier has survived over 40 financial crises and lived to tell the tale. The Swiss private bank recently strengthened its presence in the Middle East. Arnaud Leclercq, Head of the Middle East, Eastern Europe, and Central Asia tells Banker Middle East why the region is so important to the more than 200-year old institution and why he believes the bank is in a better position than most as the latest crisis unfolds.

Lombard Octier has earned itself a reputation as a reliable and long-term focused private bank. After all, it is one of Switzerland's largest independent private banks by managed assets and Geneva's oldest. Lombard Odier Darier Rentsch & Cie, as it is formally known, is headed by seven Managing Partners, representing up to the seventh generation of private bankers to lead the company. They are both owners and managers, equally involved in strategy and management as they are in client sentices.

The firm currently has close to $150 billion under management, and has a presence in the world's main financial centres, across a network of 25 offices in 18 countries. Since its founding in 1796, the firm as stayed true to its primary vocation of preserving and growing the assets entrusted to it by clients so they may hand them to future generations. In a region where family values are a top priority, Lombard Odier sees its business model as an ideal match - and is confident the firm will benefit from rising demand from UHNWI's for "stable banking with values".

The firm recently established a Dubai-based hub for 'New Markets', which encompass the Middle East, Africa, Eastern Europe, and Central Asia.

"Historically, the UAE has been a key market for Lombard Odier. Located at the centre of a region that is generating huge private wealth, we expect to attract more business in the coming years," Arnaud Leclercq said after relocating from the bank's headquarters to the UAE.

At a time of great uncertainty; punctuated by an unfolding debt crisis in Europe and fears of a banking crisis in some western countries, Lombard Odier believes its solid reputation and constant pursuit of excellence will help carry it through these latest challenges.

BME: Lombard Odier has been around for more than 200 years and has survived many crises. How has it achieved this?

Al.: It is a combination of factors. Maintaining the same core values that the bank was founded on has helped to ensure our longevity and success; understanding the importance of staying true to our firm's original core principles is no more important than in time such as now, when economic uncertainty is rife globally. We strive to focus on our priority, which is preserving and growing our clients' wealth, a goal we have pursued for more than two centuries. This singleminded approach is complemented by our ability to adapt to an ever changing world and emphasised by the fact that we are one of the few genuinely independent large private banks remaining in the world.

BME: How have you managed to limit the risks in times of crisis?

Al.: There are two key points here; as an independent private bank, our Managing Partners' liability is unlimited, meaning they are entirely responsible for the company's liabilities. It is therefore in their interests to manage risk appropriately. The second point is that, as a part of a family business going back as much as seven generations for some of our Partners, there are inherent values that compel our Firm to always act in a measured, responsible manner. This long-term perspective ensures that our business constantly adheres to strict risk management guidelines.

BME: And how do you do that?

AL: We don't do any investment banking, nor do we engage in proprietary trading. We maintain a capital ratio that is greater than 20 per cent, so we are not concerned by recapitalisation pressures. Furthermore, we are very conservative. We focus on one objective: managing our clients' assets in accordance with the level of risk they desire. As an old independent bank we are inherently extremely conservative and the foundations upon which the firm sits remain rock solid. In private banking it's especially important for clients to ask themselves if the bank that is responsible for their savings is safe. As a testament to our longevity and stability, many of our clients have been banking with us for three or four generations - we don't take excessive risks, and our history dictates that we operate responsibly.

A good example of our firm's adherence to principles and values comes from the 19th century. After visiting parts of the southern United States, one of our partners at the time, Mr Alexandre Lombard (181 0-1887) wrote a note (which we still have) saying that he was shocked by the slavery he witnessed. He considered it unsustainable and foresaw its demise, years before it finally ended. This is a simple example of our principles and values leading our actions, just as they do today, indicating in part how we have managed to weather the current crisis so well.

BME: How do you think this crisis compares to previous ones?

AL: It is very difficult to compare say, the 1929 Great Depression and the current economic crisis, both in terms of impact and responses. Today, the world is an entirely different place. We have moved from a duopoly of US and USSR hegemony, which over the past 20 years or so has transformed in a manner that no-one could have predicted. Power is far more balanced now, and many emerging economics should really be considered "emerged". Their emerging economy label

is a very western-centric term. China and India are good examples of such economies that have helped to reinforce our presence in the Middle East.

BME: What advice would you give investors for surviving another recession?

AL: I would simply say, when there is fog, slow down, get your bearings and understand your surroundings as best as possible.

BME: What are the biggest challenges for Lombard Odier going forward?

AL: First, we must strive to preserve the money of our clients, then expand their wealth before finally helping to transfer wealth to the next generation. In terms of achieving these objectives, we have successfully managed to preserve our client's money, we have avoided risks that others have taken to their cost and our clients can rest assured their money is safe in one of the world's safest, over-capitalised banks with a very stable outlook. Where investors place their money needs to be safe, obviously, but when you take a closer look at most major banks the picture is not necessarily a secure one. Achieving asset growth in the current climate is certainly a challenge, and one that has forced us to adjust our approach to investment There are some good investment opportunities, and some countries continue to post strong growth, such as those in Asia, while there are European and US companies, for instance that are managing to outperform.

BME: In which assets and more specifically, which companies do you see the opportunities?

AL: Some blue chip companies in equipment, machinery, etc. In addition, German carmakers and luxury brands continue to show promise. If you take the potential growth of global luxury brands China alone, putting aside economies such as Indonesia, Malaysia, Thailand and so on, you begin to see incredible scope for growth. If you talk about the bond market, fixed income, the common wisdom before the crisis was to say put your money in sovereign bonds, but today the picture is far less dear as the solvency of many countries, previously considered zero-risk. is increasingly questioned. More and more, corporations with piles of cash, and healthy, geographically-diversified businesses, appear a safer option. There remain ways to protect and grow your money; it has just become harder to find them.

BME: Are you seeing a change in mindset now among the investment community? Is it more about preserving wealth as opposed to growing it?

AL: The two are not necessarily mutually exclusive. The priority, is of course to organise your investments to preserve wealth as our clients typically say "Please don't lose one cent," followed by "how can we grow our assets whilst minimising risk?" Of course, this is difficult, and it demands that we are both smart and tactical because markets can change so quickly. We know that the luxury goods sector in Asia is at least a medium-term positive trend. We think some European stocks are priced cheaply, through no fault of the company, but simply because everyone is seUing and this presents opportunities. You need to avoid selling when everyone else is, in fact this is when buying opportunities present themselves - and at that point you will need a good advisor.

BME: What is your ideal portfolio in today's investment climate? And would it include equities?

AL: I don't believe there is any ideal portfolio today. First of all, as a private banker, I would listen to you; listen to what you don't want, because this is often easier to define than what you do want. Based on that we would then create a bespoke portfolio which not only matches your needs but is supported by our own research and convictions as to how best you should invest.

BME: Why did Lombard Odier make the decision to set up a hub in Dubai?

AL: The Middle East has always been important for Lombard Odier. We have been working here for the last 50 years or so and thus it's a region we know well and have built up strong and lasting relationships with some of the families here. The Middle East has always been important, but the region's importance has only grown as it has become the heart of a "fertile crescent" starting in Russia and including Central Asia, Turkey, the Indian subcontinent, the Middle East and Africa. This is an area typified by emerging countries with strong economic growth. Dubai is in the heart of it all and has built a substantial and very efficient infrastructure of ports, cargo, airlines, etc. which have helped growth and now ensures its future success.

BME: Are you seeing the Ultra High Net Worth Investor (UHNWI) easily adapting to the changing climate?

AL: They continue to focus their investments in a region that is still expanding. However, a number of these wealthy families and probably even more after the Arab Spring have decided to diversify more than they did before. An investment approach underlined by the region and what they know, and have known for generations, is now being questioned. and we are starting to see a transition to greater diversification.

BME: So you are seeing more local wealthy families becoming more willing to invest outside their comfort zone? Why should they choose you over other private banks?

AL: Let us look at the alternatives. They can invest with large banks but as this crisis has shown, these have changed greatly over the years and as they have departed from their values, the names don't resonate the same way as they did to their grandfather while their size creates issues of scale that bring risks. When we discuss family savings we are talking about more than just money. We are talking about inherited responsibilities and an obligation to future generations. These investors are increasingly considering a private bank such as ours, which consistently and for generations has followed the path dictated by our values and principles, and has brought us to the strong position we find ourselves in today.

Article published on Banker Middle East on December 2011.